Being in a car accident can be an extremely stressful affair for many people. There is quite a lot that can go into the points after a calamity, from trading with shock to creating a sense of insurance suits. Understanding what happens if your car is declared a total loss. Determining who receives the insurance check when your car is declared a total loss can have major financial implications for your recovery effort.

You could receive the payment directly in some cases, while a third party (your broker or lender) gets paid first. It is important to understand how the payout works, especially if your vehicle is financed or there are some other outstanding balances.

This article will take you through the details of who gets an insurance check when a car is totaled, by walking you step-by-step through what happens behind the scenes with your loan provider and some more aspects like Gap insurance concerning why this should be in every car owner’s knowledge.

Key Takeaways:

- Who receives the insurance check depends on factors like car ownership, financing, and lienholders.

- Lenders often receive the insurance check first if the car is financed.

- Car owners with no outstanding loans will usually receive the payment directly.

- Understanding your car’s actual cash value (ACV) is essential to navigating the claim process.

- Gap insurance can protect you from owing money if the payout is less than your loan balance.

What Happens When a Car Is Totaled?

A car is displayed totaled when the restoration costs are above a specific portion of its value, usually 70-80%, depending on the state. A higher-end insurance firm will then assess the repair costs and figure that it is not worth repairing, showing you an actual cash value (ACV) payment instead. The ACV means the car’s market value at the moment of the accident, factoring in devaluation.

What Happens After Your Car Is Totaled:

- Damage Evaluation: The insurance company transmits an adjuster to assess the injury and assess repair costs.

- ACV Calculation: The adjuster determines the ACV based on aspects such as the car’s make, example, age, mileage, and state before the mishap.

- Settlement Offer: Once the ACV is determined, the insurance company offers a payment, which can evolve complex if you still owe cash on the car.

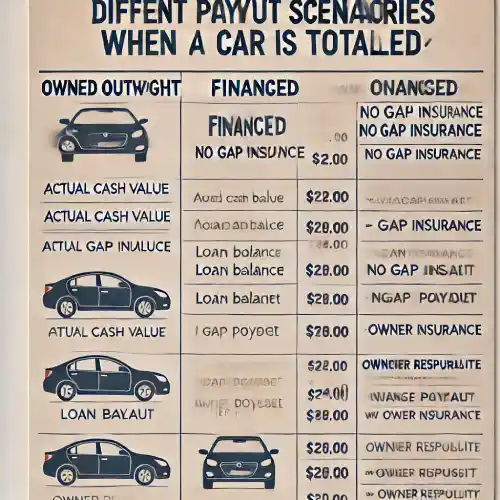

Who Receives the Insurance Check in Different Scenarios?

The primary receiver of the insurance payout hinges on whose name is currently registered as the vehicle owner. There are two main circumstances:

Scenario 1: The Car Is Owned Outright

If you own the car with no loan or lien, the insurance bill will be made out straight to you. You then have the option of how to pay your payout—whether for a car buy or other conditions.

Scenario 2: The Car Is Financed

In this case, the lender normally receives the insurance check to protect the remaining proportion of your loan. If the actual cash value (ACV) is more than what you owe, you will accept the distinction. If the ACV is less than your loan credit, you may owe money unless you have whole insurance.

How Lienholders Affect Who Gets the Insurance Check

Lienholders have the right to collect the insurance payout, especially when the vehicle is financed. Since they have a financial interest in the car, they are usually paid from the insurance check first.

Why Does the Payment Go to the Lender?

The lender has a contractual right to cover its acquisition of the vehicle. If the car is totaled, they provide the loan is fully settled before any remaining accounts are given to the landlord. Typically, the insurance business makes the check expected to both you and the lender, requiring both players to support it before the lender gets paid.

The Role of Gap Insurance When a Car Is Totaled

Many drivers, particularly those who owe more on their car loan than the vehicle’s need value, find gap insurance invaluable. Without good range, such as actual cash value (ACV) insurance, a total loss could leave you with an excellent loan balance even though the car no extended exists.

Benefits of Gap Insurance:

- It covers the difference between your loan balance and the insurance payout.

- Protects you from being responsible for a car you can’t drive anymore.

- Especially useful for new or quickly depreciating vehicles.

Without gap insurance, you could owe a large amount if your car’s value has significantly depreciated since purchase.

How Actual Cash Value (ACV) Impacts the Insurance Payout

Your vehicle’s actual cash value (ACV) is a major driver of how much money you receive from insurance. The ACV is used by insurance companies to determine the amount they will pay you when your car gets totaled.

ACV Changing Factors

- Depreciation: Cars are a depreciating investment, losing value from age, mileage, and model and tear.

- Market Conditions: Images of the price similar cars have been selling for in your exact terrain.

- Condition: What your car was like before… how well you kept your vehicle.

- High-Mileage: Generally, the higher a vehicle’s mileage, the lower its ACV will be.

Therefore, knowing how your insurance company estimates ACV is necessary to make sure you get the compensation that you deserve. If you feel the ACV is too soft, deal with or use your car’s need to prove total loss and potentially get a more elevated valuation.

Can You Keep the Car After It’s Declared Totaled?

However, in some circumstances, you may wish to retain your car after the insurance company has said it is a total loss. If you can do this will again rely on the laws of your condition and also what is in your policy.

What Happens:

- Salvage Value: If you elect to keep your vehicle, the insurance company will deduct its salvage value from what it should pay out. This will be the amount the vehicle could sell for in its damaged condition.

- Registration and Insurance: You must register the car as a salvage vehicle, which may make it difficult to insure fully.

On the other hand, keeping a totaled car might not always be advisable; many vehicles can become more expensive to make roadworthy than what they are worth post-crash.

How to Ensure a Fair Settlement in the Total Loss Process

You should be proactive about getting the biggest settlement possible in a total loss situation. Here are steps you can take to ensure a fair payout:

- Document Everything

Take photos of the damage, keep logs of your car’s care history, and hold onto receipts or records related to any promotions or customizations.

- Research Your Car’s Value

Use websites like Kelley Blue Book or Edmunds to calculate how much you should be able to get for your vehicle, founded on its shape and characteristics. This can be helpful during negotiations with your insurance company.

- Negotiate If Necessary

If the insurance offer appears too low, don’t pause to deal. Provide proof of a higher ACV or request another review.

- Know Your Coverage

Understand your insurance procedure before filing a lawsuit to avoid pitfalls related to payout charges and exclusions.

Conclusion

Insurance payout when the car is totaled: Who gets it? Where a check goes – to you or your lender – is based on the ownership status of that car, but gap insurance and ACV also determine how everything shakes out.

If you were recently in an accident, and especially if your car was damaged or totaled due to a no-insurance collision, take the time to thoroughly know how much insurance coverage is on that vehicle of yours; file down what it’s worth now (if anything); and push for fair payment.

Tell us your total loss experience! Have you ever had experience with your insurance company? Offer your feedback in the comments, and read our blog posts about car insurance tips, as well as financial protection for drivers.